- 800 000+ traders

- $10 minimum deposit

- 1:Unlimited leverage

- Instant Withdrawals in Seconds

- Why Exness is the Ideal Choice

- Exness Regulation

- Reviews from Indian Traders

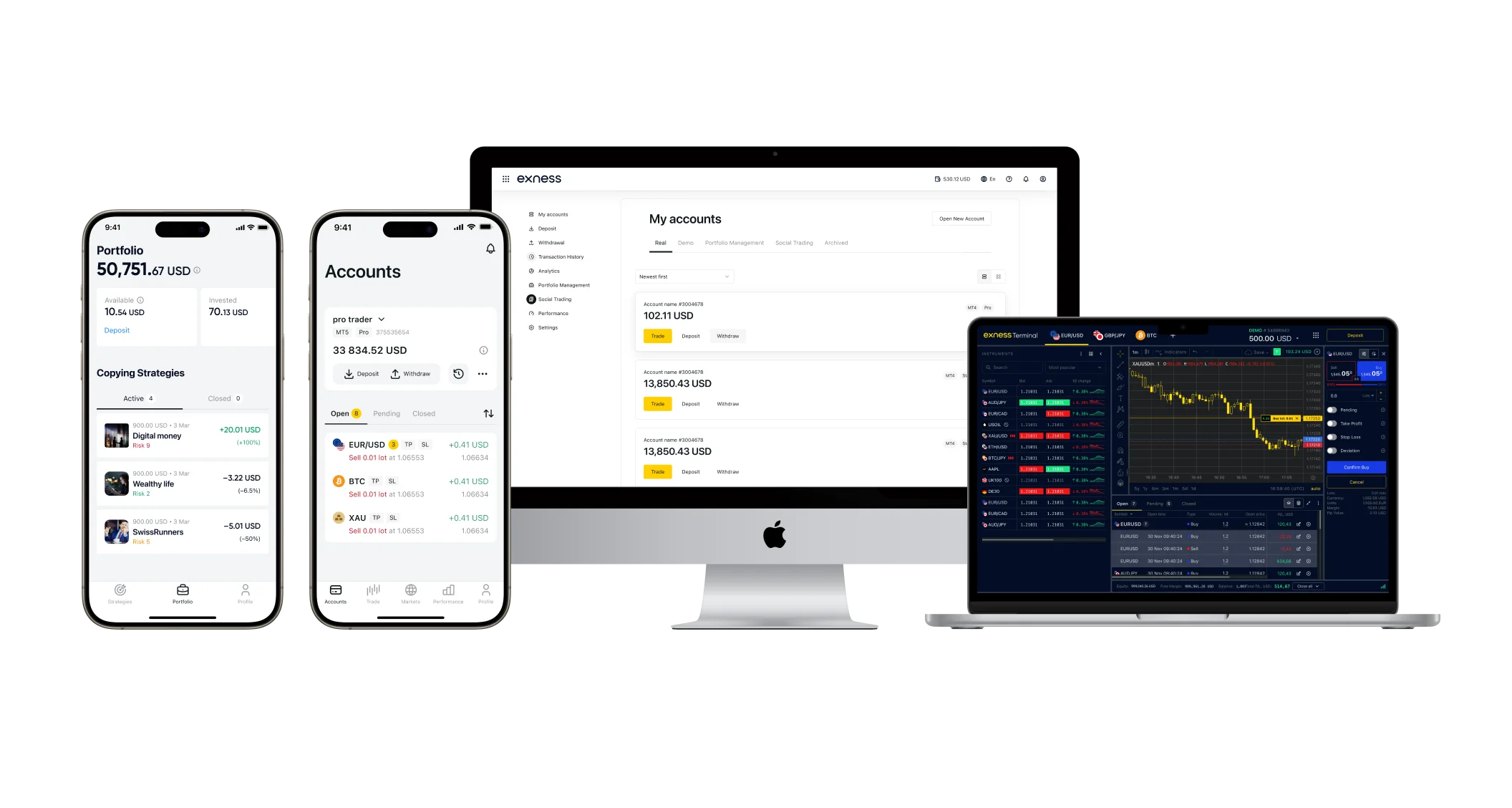

- Exness Trading Platforms

- Exness Trading Instruments

- Types of Exness Accounts

- Exness Standard Accounts

- Exness Professional Accounts

- Exness Demo Account

- Exness Social Trading

- Comparison of Accounts

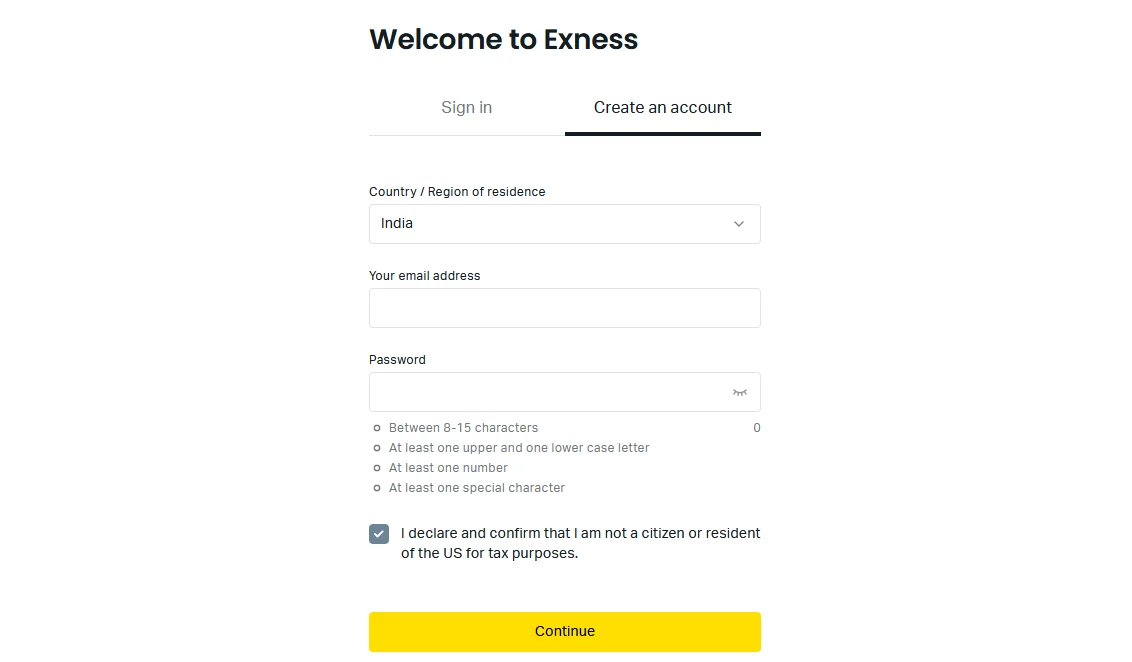

- Exness Account Registration

- Security of Exness

- Deposit and Withdrawal of Exness Funds

- Support for Indian Payment Methods

- Exness Educational Resources

- Exness Customer Support

- Bonuses and Rewards Offered by Exness

- Compliance With Indian Regulations

- FAQs

The Importance of a Reliable Forex Broker for Traders

A reliable forex broker is very important for traders. It ensures smooth trading, accurate data, and good platforms. It also provides security, support, and follows rules to protect traders. This builds confidence for successful forex trading.

Why Exness is the Ideal Choice

Exness is ideal for Indian traders. It is regulated for transparency and follows standards. Exness offers many trading instruments. Its platforms MT4 and MT5 have advanced tools for efficient trading.

Exness provides education resources to improve trader knowledge. It has account types for different trading styles. Exness has clear conditions, competitive pricing, and various payment options. This makes Exness a trusted partner for online trading in India.

About Exness

Exness is an online broker that started in 2008. It is based in Cyprus but serves traders globally, including India. Here are some key facts about Exness:

- Global Presence: It has offices in several countries, allowing it to provide localized support and services to traders worldwide.

- Regulated Entity: Regulated by over 5 financial authorities, ensuring compliance and security.

- Trading Volumes: Serves over $5 trillion in monthly trading volumes on its platforms.

Regulation and Licenses

Exness operates under the supervision of several reputable regulatory authorities in different jurisdictions. Here are some of the licenses and regulatory bodies that govern Exness’ operations:

- Cyprus Securities and Exchange Commission (CySEC): Exness (Cy) Ltd. is authorized and regulated by CySEC with license number 178/12.

- Financial Conduct Authority (FCA) in the United Kingdom: Exness (UK) Ltd. is authorized and regulated by the FCA with license number 730729.

- Financial Services Authority (FSA) in Seychelles: Exness (SC) Ltd. is authorized and regulated by the FSA with license number SD025.

- Financial Sector Conduct Authority (FSCA) in South Africa: Exness ZA (PTY) Ltd. is authorized by the FSCA with FSP number 51024.

Reviews from Indian Traders

Sandeep Mishra, Mumbai

Exness gives fast withdrawals, low spreads, and helpful customer service. I’ve had zero issues with them, and my trades always go through quickly.

Ananya Patel, New Delhi

I like how reliable Exness is. Their mobile app and desktop platform both work perfectly, making trading easy. Their guides have improved my trading skills a lot, and the overall experience has been positive from the start.

Rahul Singh, Bengaluru

Exness’ automatic withdrawal is a game-changer. I get my money in seconds. The platform is easy to use and has good tools to spot trades.

Priya Desai, Chennai

The demo account helped me practice trading before using real money. Their support team answers questions quickly and is always friendly. The account options and the simple registration process made my transition to live trading seamless.

Exness Trading Platforms

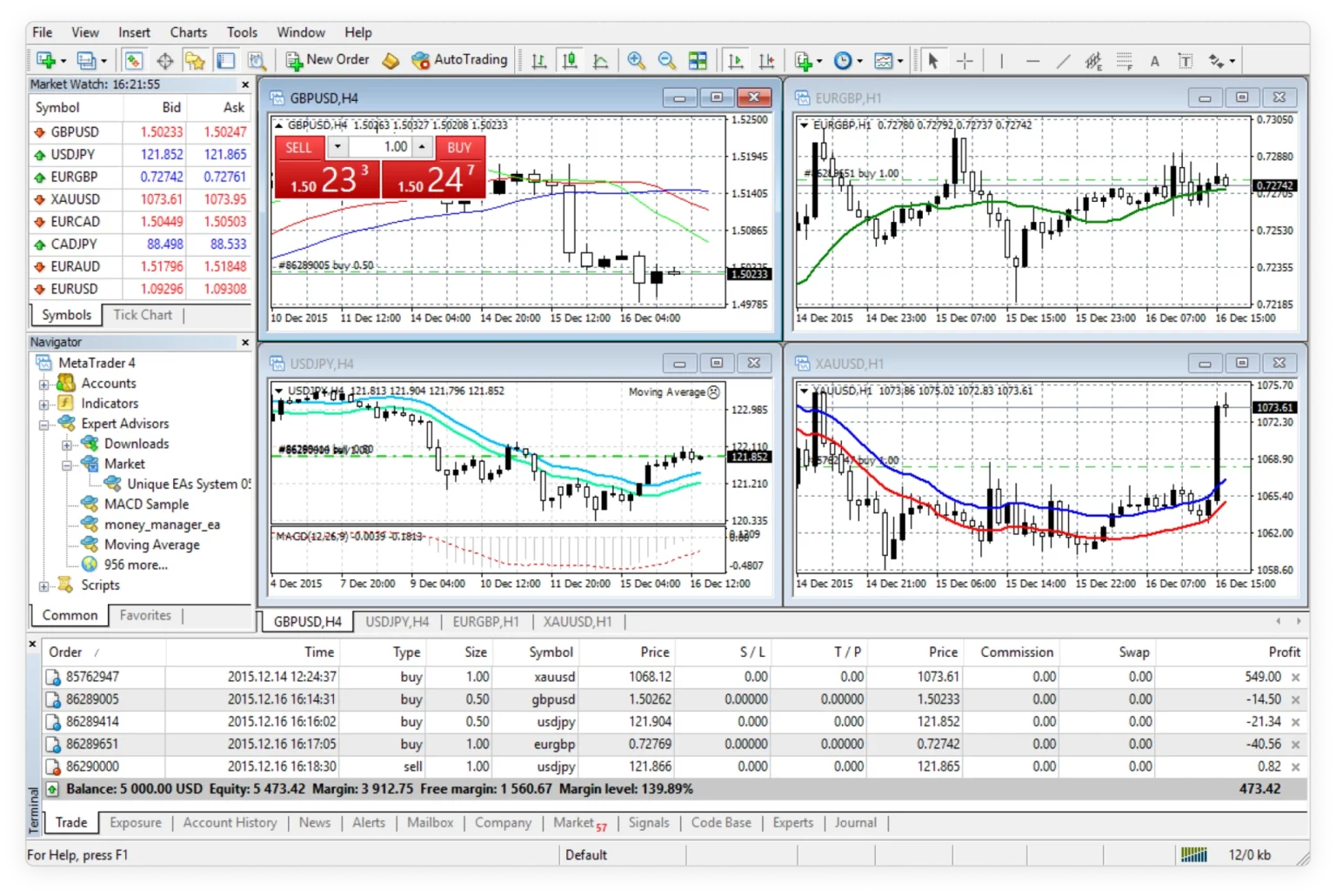

The broker offers a wide range of trading platforms. Traders can choose between MetaTrader 4, MetaTrader 5, the Exness Terminal, and the MetaTrader WebTerminal. Mobile apps are also available, such as the Exness app and the MetaTrader 4/5 mobile app. Each platform provides its own unique set of tools and features. Without a doubt, the most popular choices for traders are the MT4 and MT5 platforms.

Exness MetaTrader 4 (MT4)

MetaTrader 4 provides access to over 200 instruments including forex, indices, and cryptocurrencies. You can use six types of pending orders, customize trading signals, and tweak your strategy with 30 technical indicators. Fast execution means that your trades are processed in milliseconds. MT4 is suitable for both beginners and experienced traders.

Exness MetaTrader 5 (MT5)

MetaTrader 5 builds on the success of MT4 with more advanced features and a modern interface. It comes with 38 technical indicators, 21 timeframes, and better tools like an economic calendar and depth-of-market. It supports netting and hedging trading systems, providing even greater flexibility and precision in managing your trades.

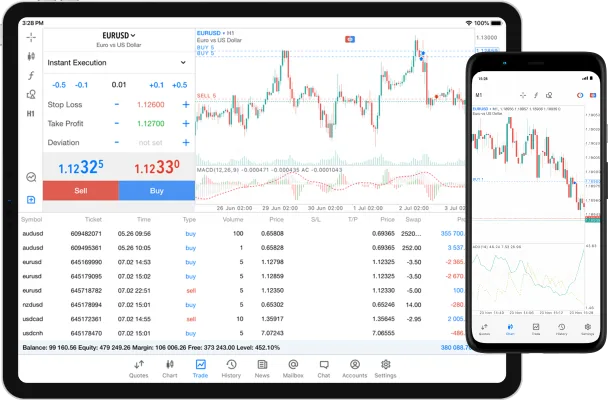

Exness Mobile Apps

The broker offers user-friendly mobile apps that allow traders to trade with similar functionality to the desktop version. The Exness Trader app is a proprietary mobile platform that offers features such as one-touch deposits and withdrawals, real-time charts, and market news. It is available for users on Android and iOS. You can access over 100 financial instruments using the app.

For those who prefer the MetaTrader platform, Exness also provides MetaTrader 4 and MetaTrader 5 mobile apps.

Exness MetaTrader 4 mobile

The MT4 mobile app works on both phones and tablets. It has all the trading features you need, like chart analysis and fast execution.

Exness MetaTrader 5 mobile

MT5’s mobile app has more chart types and tools than MT4. You can analyze trades, get news alerts, and manage your positions – all from your phone.

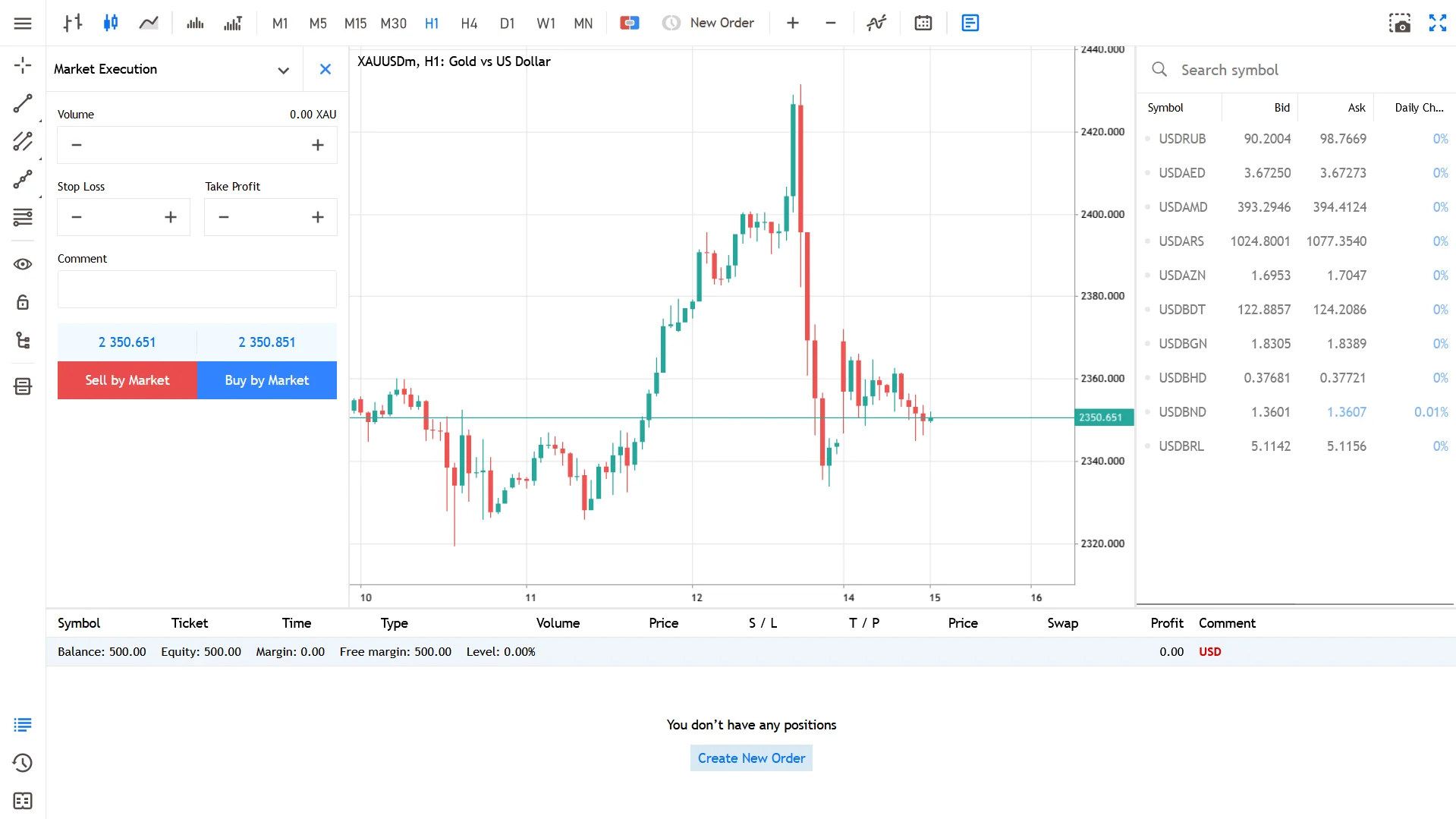

Exness Web Terminal

The Exness WebTerminal is a web-based trading platform that works directly from your browser. You can analyze charts and trade quickly without installing any software. It features 9 timeframes, 30 indicators, and 3 chart types to help you spot trading opportunities. Simply sign up, choose from 5 account types, and you’re ready to use the WebTerminal.

Exness MetaTrader WebTerminal

This version of MetaTrader 4 or 5 allows you to trade from any device via a browser. You can access real-time market data, analyze charts, and execute trades quickly.

Trading Instruments Available at Exness

Exness provides a large selection of 200+ trading instruments, which gives traders ample opportunities to earn money.

Forex

More than 100 currency pairs including majors such as EUR/USD and GBP/USD as well as minors and exotics. With up to 1:2000 leverage available, you can customize your trading strategy to suit your risk preferences. Competitive spreads start at 0.1 pips.

CFDs on Stocks

Access over 70 stock CFDs across technology, consumer goods, and other sectors. You can trade shares like Apple (AAPL) and Tesla (TSLA) with low commissions and leverage up to 1:20.

CFDs on Indices

Trade CFDs on 10+ indices including NASDAQ 100 and FTSE 100. Take advantage of low spreads and leverage of up to 1:100.

Commodities

Exness offers CFDs on popular commodities like gold, silver, crude oil, and natural gas. With spreads starting from 0.1 pips and leverage up to 1:200, you can find new opportunities.

Crypto

In addition to traditional markets, Exness allows traders to speculate on the price movements of 8 popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

Types of Exness Accounts

Exness offers 2 types of accounts, which are divided into Standards (Standard, Standard Cent) and Professionals (Raw Spread, Zero, Pro).

Exness Standard Accounts

| Account Type | Minimum Deposit | Leverage | Spreads From | Commission |

|---|---|---|---|---|

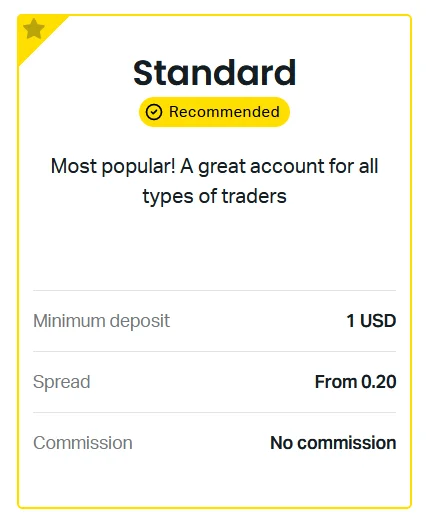

| Standard | No minimum | Up to 1:Unlimited | 0.3 pips | None |

| Standard Cent | No minimum | Up to 1:Unlimited | 0.3 pips | None |

Standard

The Standard account is great for most traders, offering no commissions and low spreads. It provides full access to a wide range of trading instruments like forex, metals, and indices.

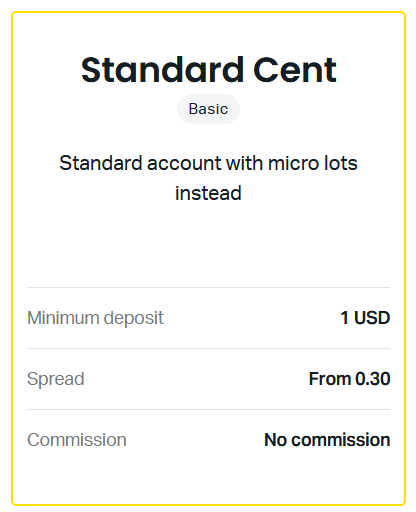

Standard Cent

The Standard Cent account is perfect for beginners. It lets you trade in smaller “cent lots” while learning to manage risk and test strategies.

Exness Professional Accounts

| Account Type | Minimum Deposit | Leverage | Spreads From | Commission Per Lot |

|---|---|---|---|---|

| Raw Spread | $200 | Up to 1:2000 | 0.0 pips | Up to $3.5 |

| Zero | $200 | Up to 1:2000 | 0.0 pips | From $0.2 |

| Pro | $200 | Up to 1:2000 | 0.1 pips | None |

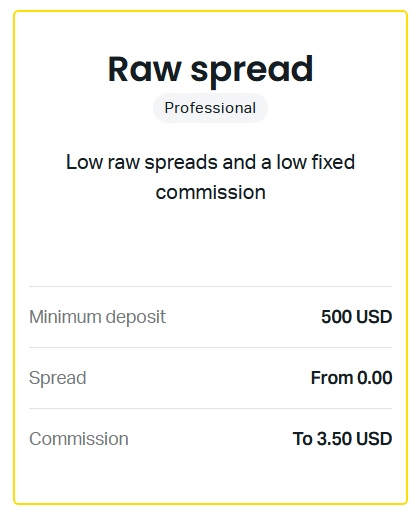

Raw Spread

The Raw Spread account is designed for traders looking for low spreads. Spreads can be as low as 0.0 pips, but a small commission per lot is charged.

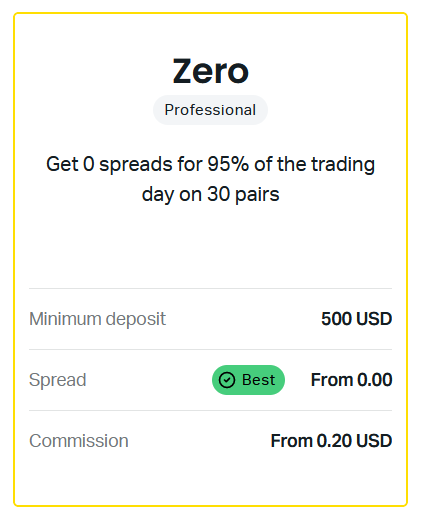

Zero

With spreads starting at 0.0 pips for 95% of the trading day, the Zero account is a top choice for precise trading strategies. Commissions are charged per lot.

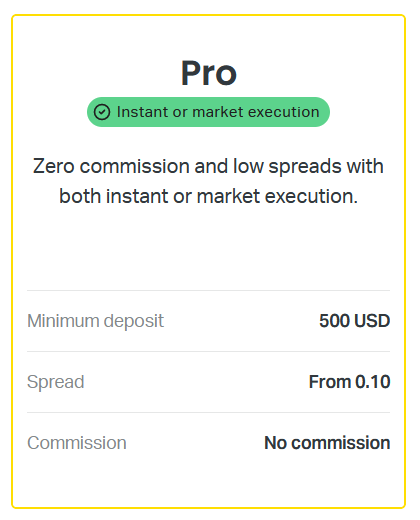

Pro

The Pro account offers tight spreads from 0.1 pips and no commission, which is ideal for traders who want professional-level conditions.

Exness Demo Account

A demo account is a risk-free way to practice trading. Exness provides demo accounts for all its trading platforms, including MetaTrader 4, MetaTrader 5, and Exness Trader. Each demo account gives you access to over 100 financial instruments, including forex pairs, CFDs on stocks, indices, and commodities. You can start with a virtual balance of up to $10,000 to test your strategies in real market conditions with leverage up to 1:2000. This allows you to refine your skills and become familiar with various trading tools before switching to a live account.

Exness Social Trading

Exness offers a social trading platform, which enables traders to follow and copy the strategies of successful traders. This makes it easier for beginners to learn and earn by following the lead of top traders.

Comparison of Accounts

Here’s a summary of Exness account types to help you choose the right one for your trading needs:

| Account Type | Minimum Deposit | Leverage | Spreads From | Commission | Market Execution | Maximum Orders | Minimum Position Size | Trading Platform(s) |

|---|---|---|---|---|---|---|---|---|

| Standard | No minimum | Up to 1:Unlimited | 0.3 pips | None | Yes | 1,000 | 0.01 lots | MT4, MT5 |

| Standard Cent | No minimum | Up to 1:Unlimited | 0.3 pips | None | Yes | 1,000 | 0.01 cent lots | MT4 |

| Raw Spread | $200 | Up to 1:2000 | 0.0 pips | Up to $3.5/lot | Yes | 1,000 | 0.01 lots | MT4, MT5 |

| Zero | $200 | Up to 1:2000 | 0.0 pips | From $0.2/lot | Yes | 1,000 | 0.01 lots | MT4, MT5 |

| Pro | $200 | Up to 1:2000 | 0.1 pips | None | Yes | 1,000 | 0.01 lots | MT4, MT5 |

Standard Accounts vs. Professional Accounts:

- Standard accounts are ideal for most traders with no commissions and wider spreads.

- Professional accounts have tighter spreads but apply commissions or require a minimum deposit.

Demo vs. Live Accounts:

- Demo accounts use virtual funds to practice trading strategies.

- Live accounts involve real money and give you full access to market trading instruments.

Simple Exness Account Registration Process

Registration with Exness has a few steps and takes only a couple of minutes. Just follow these steps, and you’re all set:

- Sign Up: Visit the Exness website or use the Exness app. Click on “Open Account” and provide your email, country of residence, and password.

- Verify Information: Fill out your personal details and verify your identity by submitting the required documents (like a passport or driver’s license) to complete the KYC process.

- Choose Account Type: Select the type of trading account that matches your needs, such as Standard, Pro, or Raw Spread.

- Deposit Funds: Add funds using any of the available local or international payment methods to start trading.

- Start Trading: Access your preferred trading platform (MT4, MT5, or Exness Terminal) and begin trading with your newly created account.

Protection and Security of Exness Broker

Exness guarantees the protection and safety of its customers. Here’s how:

- Segregated Accounts: Client funds are kept separate from Exness’ operational funds, providing extra security for your money.

- Compensation Fund: As a member of the Financial Commission, Exness offers up to €20,000 per client in case of dispute.

- SSL Encryption: All data exchanged between the trading platforms and Exness servers is encrypted using SSL technology to protect your sensitive information.

Two-factor authentication (2FA) adds another layer of security to your account. It helps prevent unauthorized logins and ensures that only you have access.

Exness also runs regular security checks and has a cybersecurity team that monitors everything 24/7 to keep your data safe.

Exness Trading Conditions

Exness offers some of the most favorable trading conditions for traders. Spreads start from as low as 0.0 pips on specific accounts, while leverage can go up to 1:Unlimited for Standard accounts and 1:2000 for Professional accounts. Market execution ensures fast trade fulfillment, and there are no hidden fees. Plus, Exness provides negative balance protection to prevent your account from going below zero.

Deposit and Withdrawal of Exness Funds

Deposits and withdrawals with Exness are straightforward. You can deposit funds starting from as low as $1, and your withdrawals are processed instantly. With no extra fees for most payment methods, you can easily fund your account using local payment options, e-wallets, bank transfers, and credit/debit cards.

Support for Local Payment Methods in India

- UPI (Unified Payments Interface): Make instant transactions directly from your bank account.

- Paytm: Use this popular mobile wallet for quick deposits and withdrawals.

- Indian Net Banking: Secure online banking with direct fund transfers to and from your account.

- Local Bank Transfers: Transfer funds directly between your Exness account and your local bank.

These payment options help Indian traders manage their funds in their local currency.

Exness Educational Resources

Exness offers valuable tools to help traders improve:

- Webinars: Live sessions led by market experts, often with 2-3 sessions per week.

- Articles: Written guides covering 10+ trading strategies and key market trends.

- Video Tutorials: Over 30 step-by-step videos for both beginners and experienced traders.

- Exness Academy: An online hub where traders can find market analysis and educational content.

Exness Customer Support

Exness provides 24/7 support through live chat, email, and phone. Support is available in 15+ languages, including English, Hindi, and Chinese. This makes it easy to get assistance on common issues or complex trading questions.

The Exness Help Center is also packed with FAQs and guides on trading platforms, account setup, and security, so traders can find quick answers.

Bonuses and Rewards Offered by Exness

While Exness does not currently offer bonuses, the Exness Premier program provides high-volume traders with exclusive benefits like faster withdrawals, personal account managers, and market insights. This loyalty program rewards traders for their activity.

Compliance With Indian Regulations of the Exness Broker

Exness follows strict international guidelines to comply with Indian trading rules. The broker adheres to the Financial Services Authority (FSA) standards and regularly audits its operations to meet global standards.

The broker uses Know Your Customer (KYC) checks to verify identities and follows Anti-Money Laundering (AML) procedures to stop fraudulent activity. These steps ensure transparency in every transaction.

Regular audits and clear internal rules keep Exness compliant and offer traders a safe, fair environment to trade within Indian regulatory guidelines.

FAQs

Is Trading with Exness Safe and Reliable in India?

Yes, Exness is safe and reliable. It follows international regulations and keeps client funds in separate accounts. It also uses 128-bit encryption to protect personal data, ensuring Indian traders can trade confidently.