Why Use Exness Calculator?

The Exness trading calculator is an essential tool for trading. He will make important calculations before making the deal. Namely the margin, cost of points and possible profit or loss. This makes it easier to plan your trades.

Using the Exness Calculator is a smart choice for any trader. The calculator will save your time and provide accurate calculations, which will reduce your trading risks.

Key Features of Exness Calculator

The Exness Trading Calculator has many useful features. Here are the main ones:

- Wide Calculation Parameters: The calculator will take into consideration other several factors like type of account, trading instrument, lot size and leverage to give you the correct result.

- User-Friendly Interface: This dashboard has been crafted to be easy to use for anyone from newbies starting trading to advanced users.

- Instant Results: The results are instant on your trades. This includes potential profits, the margin needed, pip value, and swap rates.

- Risk Management: Allows you to see the risks of each operation and make a plan with minimal losses.

- Customizable Inputs: The user can change the inputs to suit his/her trading style and requirements.

Calculation Parameters

To get accurate results, you need to understand the parameters used in the Exness Calculator. Here are the key parameters:

- Account Type: Different Exness accounts have different rules. Knowing your account type helps in accurate calculations.

- Instrument: This is what you’re trading, like currency pairs, commodities, or indices.

- Lot Size: This is the size of your trade. It affects your margin and potential profit or loss.

- Leverage: This shows how much money you’re borrowing to trade. Higher leverage can mean higher risk.

- Bid and Ask Prices: These are the prices at which you can buy or sell the instrument.

How to Use the Exness Calculator

Using the Exness Calculator is simple and can help you make informed trading decisions. Here’s how to use it effectively.

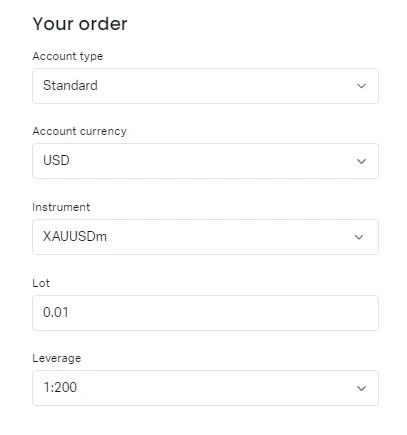

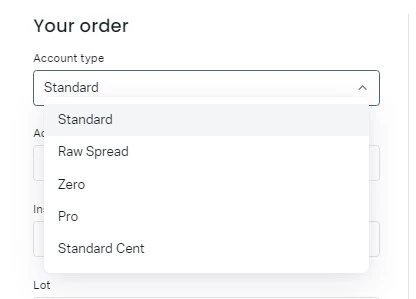

Selecting Account Type

Start by choosing your account type. Exness offers several options, including Standard, Pro, Raw Spread, and Zero accounts. Each account type has different trading conditions, like spreads and commissions, so it’s crucial to select the correct one. For instance, if you’re using a Raw Spread account, select it in the calculator to get the most accurate results tailored to your trading environment.

Choosing Instrument and Lot Size

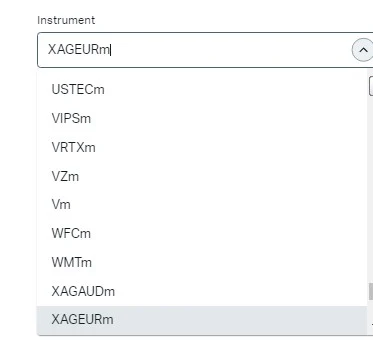

Next, select the trading instrument and lot size. The Exness Calculator supports a wide range of instruments, such as forex pairs like EUR/USD, metals like XAU/USD (Gold), and cryptocurrencies like BTC/USD (Bitcoin). After choosing your instrument, input the lot size you intend to trade. For example, if you plan to trade 0.5 lots of XAU/USD, enter “0.5” in the lot size field.

Setting Leverage

It all depends on how much leverage you choose to trade with. You can specify the leverage with which we operate on your trading account. For instance, if your account leverage is 1:200 then enter that value in the leverage field. The level of leverage you use will determine the margin required and also how much profit or loss your trade receives.

Calculating Results

After providing all the information, now hit calculate to get results The calculator will also give you key figures, like required margin, pip value and potential profit or loss. For instance, if you are trading 1 lot of EUR/USD on a leverage of higher than 200 your margin required to open that trade might say $500, It will also display the pip value which reflects you how much money is made or loss on each 1 pip moves in a market.

If you find it easier to understand information through video, feel free to watch the video below. It guides you step-by-step on how to use the Exness calculator for precise trade calculations.

Tips for Accurate Calculations

In order to make the use of the Exness Calculator as effective as possible, the following guidelines should be followed:

- Confirm Your Inputs: before you press the Enter key, always ensure that you correctly put your account type, instrument lot size and leverage. Inaccuracies resulting from tiny but important errors.

- Real-Time Market Prices: use the current market prices while performing your costings so you stay up to date with it. The market can be a volatile place and data that is up to date is essentia

- Know Your Parameters: know what each parameter does and how it factors into your calculations. This in turn will help to make better trades.

- Input Realistic Numbers: Add in realistic numbers that is fit with your trading strategy and goals. You should avoid any extreme values that do not represent your trading plan.

- Analyze your results: Check the result carefully. Verify the potential profit, margin and more details are inline with your expectations and strategy.

Understanding Exness Calculator Results

When you use the Exness Calculator, you get important information about your trade. A quick guide to the result:

Margin

A Margin is an initial amount you have to put down (to get) into a trade. A small percentage of the total trade size. This calculator calculates the necessary margin for your account type and lot dimension when you are utilizing any leverage level. This aids you using a little so that you know how much to save towards your trade.

Spread Cost

Spread cost: it is the price between the buy/sell of a particular instrument. It might be considered a trading fee. This is the fee that marks on for each trade and will be shown in the calculator so you know how much it is costing to make any specific trades.

Commission

Commission – a fee that a broker may charge for each trade. The Exness Calculator will inform you about whether a commission fee exists and what is the rate of it. Knowing this helps you understand the total cost of your trade.

Swaps (long and short)

Swaps are interest charges for holding a trade overnight. You have long swaps for buy trades and short swaps in case of sell trades. Swap rates (either costs or earnings) are set as seen in the calculator. This helps you see if you will pay or earn interest for holding your trade overnight.

Pip Value

Pip value is the money you make or lose for each pip movement in the price. The calculator figures out the pip value based on your lot size and trading instrument. Knowing the pip value helps you see how much you can gain or lose in a trade.

Using Exness Trade Calculator for Risk Management

The Exness Trade Calculator is very useful for managing risks in your trades. It helps you see what might happen before you make a trade. Here’s how it can help you:

- Plan Your Trades: You can try different settings to see how changes affect your trade. This helps you plan better.

- Set Stop Loss and Take Profit: The Calculator makes it possible to set the stop-loss (to limit losses) and take-profit (to fix profits) as best as possible. This way your money stays safe.

- Understand Your Risk / Reward: It helps you decide whether a trade needs to take or not based on your possible risks and rewards. This helps you to take informed and safer trades.

Comparing Different Trading Scenarios

Knowing how a particular trading scenario can affect your income is of great importance for your decision-making. With the help of the calculator, you can consider various scenarios.

Imagine you are trading the EUR/USD pair but at different leverage and lot sizes:

| Parameter | Scenario 1 | Scenario 2 |

| Instrument | EUR/USD | EUR/USD |

| Lot Size | 1 lot | 0.5 lots |

| Leverage | 1:100 | 1:500 |

| Account Type | Standard | Pro |

| Required Margin | $1,000 | $100 |

| Pip Value | $10 per pip | $5 per pip |

| Potential Profit/Loss | $100 per 10 pip movement | $50 per 10 pip movement |

Analysis of Scenarios

In Scenario 1, you’re trading 1 lot of EUR/USD with a leverage of 1:100 on a Standard account. The required margin for this trade is $1,000, and each pip movement is worth $10. This means that for every 10 pip movement in the market, your profit or loss would be $100.

In Scenario 2, you’re trading 0.5 lots of EUR/USD with a higher leverage of 1:500 on a Pro account. Here, the required margin drops to $100, and each pip is worth $5. So, for every 10 pip movement, your profit or loss would be $50.

Comparing the Outcomes

The leverage and lot size options of these scenarios give an idea how the trades can influence your trading. Higher leverage means a lower margin. Less lot sizes means less profit, but lower risk as well. By changing these, you can find out how different trading scenarios could end up using the Exness Calculator to trade smart.

FAQs about the Exness Calculator

How to calculate margin using the Exness Calculator?

All you have to do is input your account type, trading instrument, lot size and leverage. The calculator will tell you the amount of margin that is required for your trade.