Exness Payment Methods

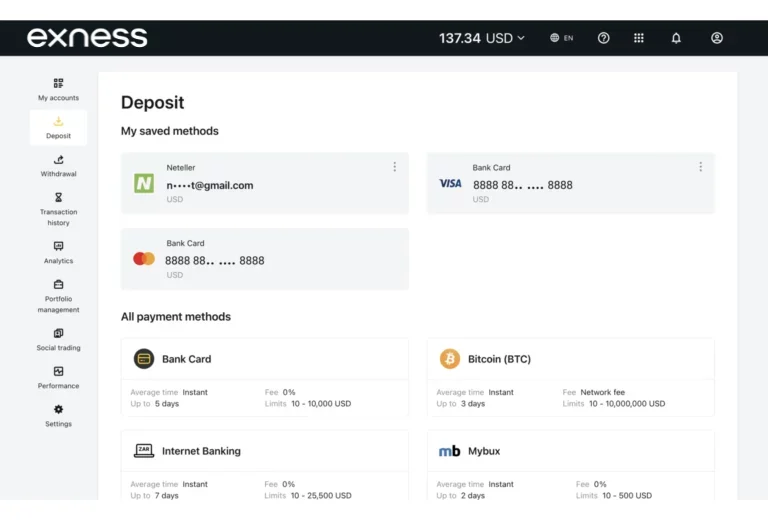

All types of payment systems available to you are listed in your account. The list of payment methods can be found in sections such as “Deposit” or “Withdrawal”. To select the appropriate method, you need to log in to Exness account using your access data and open the necessary tab. All the sections that can be accessed in the personal account are located on the vertical panel on the left side of the main page.

Upon opening the section, you will see the transaction amounts that can be used for each payment method and how long it takes to process a request. For the transaction, you will need to choose the most acceptable and convenient payment method for you. You can align your next actions with the instructions that will accompany each step of yours for a successful money transfer.

Additionally, during the process, you can refer to information, and after completing the transaction, save the payment method in your account. This will allow for subsequent deposits and withdrawals of currency, to use this payment system, add to the list by other methods, and make adjustments to it. If the preferred payment method is unavailable for some reason, you can use an alternative option:

- Bank transfer.

- Debit or credit card.

- WebMoney international payment system.

- Neteller electronic wallet.

- Skrill electronic payment system.

By becoming a client of the Exness broker, you gain the ability to choose between local or international payment methods for depositing funds into your trading account and withdrawing the finances earned from transactions. Please note that some payment methods are only suitable for residents of certain regions.

Regional Payment Methods

Such local methods are only available with an account that is registered in a specific country. Please note that despite your desire, you will not be able to manually change the country, although the other profile parameters can be adjusted. If you’ve moved to a different region and want to use the payment systems available there, you’ll need to register new Exness account.

Debit and credit cards are often considered local methods. For a trading account, bank cards that support international transfers, among other things, are suitable. Before using your payment card, make sure that the issuing bank corresponds to the region you specified when registering your account. All operations with a bank card are subject to specific rules, such as priority or filling out an application for expense reimbursement.

Global Payment Methods

Global payment methods are predominantly available for all trading accounts. But this doesn’t mean that you don’t need to verify your account. For a successful payment, Exness account verification is a necessary procedure. After completing it, you become a full-fledged client of the brokerage company and receive many privileges, including increased limits and hassle-free currency transfers.

To the list of global methods, meaning those that are not dependent on geographical location, electronic payment systems are included. The broker offers two main types of digital tools for saving funds, managing, and executing financial operations. These are electronic wallets like Skrill and Neteller. They are distinguished by the speed of payments and a high level of security. But at the same time, one should not forget to log into their account to receive secure access to trading accounts.

Base Currencies in Exness

Exness is an international, and therefore multi-currency, brokerage company. And clients can engage in trading on financial markets using the currencies of different countries. The broker supports various currency options for trading accounts, including both less commonly used and more widely used currencies.

The list of base currencies used for standard accounts includes the following monetary units: UAE Dirham; Argentine, Philippine, and Mexican Peso; Azerbaijani Manat; Bahraini, Kuwaiti, Jordanian Dinar; Swiss Franc; Chinese Yuan; Egyptian Pound; Ghanaian Cedi; Hungarian Forint; Indian, Indonesian, and Pakistani Rupee; Japanese Yen; South Korean Won; Kenyan and Ugandan Shilling; Kazakhstani Tenge; Moroccan Dirham; Malaysian Ringgit; Nigerian Naira; Omani and Qatari Riyal; Saudi Riyal; Uzbek Sum; West African Franc; South African Rand; Vietnamese Dong; Australian, Canadian, Bruneian, Hong Kong, New Zealand, Singaporean, and United States Dollar; Euro; Ukrainian Hryvnia; Pound Sterling.

The base currency that you prefer for trading operations is selected after creating an account. When configuring your trading account, you specify the currency from the list of available options. This choice cannot be changed, so think carefully before making it, about which currency would be more profitable and preferable for you to trade in. If you want to operate with multiple types of currency, you will need to open a separate trading account for each base currency unit. Consider whether the trading account supports the selected base currency. There’s no need to create an account for each invoice. In one personal account, you can have multiple active accounts.

Making a Deposit in Exness

The process of depositing funds into a personal account is carried out in a simplified manner. To deposit money, you need to follow a few steps.

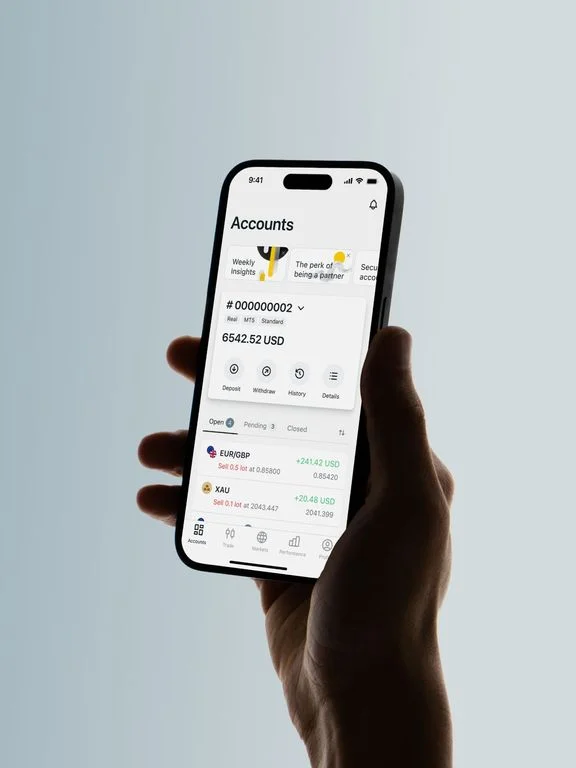

- Initiating a money deposit starts with logging into your account. You can log into your account either through the official broker website or via the Exness trade app.

- After logging in and accessing your account, enter your personal account area.

- This action will allow you to access the necessary section – click the “Deposit” button, which is located on the sidebar menu.

- You will see a list of supported payment systems: electronic wallets, debit and credit cards, bank transfers. Choose your preferred payment method, taking into account criteria such as transaction speed, set limits, types of currencies, and the size or absence of fees.

- From the list, choose the base currency, considering that you will not be able to change your choice later. Enter the amount you want to transfer to the deposit. Please provide your trading account number.

- Confirm the payment, a process that has its own peculiarities depending on the chosen payment instrument. In any case, instructions will appear on your screen. If you adhere to it, the money will be transferred to the deposit quite quickly. The result of a successful transaction will be reflected in your personal trading account as a credited amount. After this, you can start making active transactions with the aim of generating profit.

Minimum Deposit in Exness

Every type of payment, including depositing funds into an account, has size limitations. Limits, as well as the presence or absence of fees, depend on aspects such as the chosen payment method and the type of trading account. If you use a standard trading account for transactions and storing funds, the minimum allowable deposit amount can be $1. Therefore, a standard trading account is most commonly used by both beginners and experienced traders who prefer to trade without risks but with good potential. Sometimes, even a minimal amount is enough to close a profitable deal, acquire an initially illiquid asset that will eventually yield substantial profit.

Experienced traders, accustomed to handling large sums and substantial volumes, open a professional trading account. And in this case, they will have to contribute at least $200. The limit isn’t small, but the corresponding income will also be quite large. Moreover, a professional account is characterized by criteria such as a variety of financial instruments and functions, tight spreads, and instant order execution.

Deposit Limits and Fees

Please note that the broker does not charge a commission for internal deposits. The exception is a deposit with currency conversion. And an additional fee is already being charged by a third party that processes the payments. For example, if you deposit 500 US dollars and the base currency of your account is indeed in USD, then that is the amount you will receive. The commission will not be charged. Deposit limits depend not only on the type of account. Plays a role in the minimum allowable amount of monetary credits, and the chosen method of payment:

- Debit or credit bank cards – Exness minimum deposit for a single transaction is $10.

- Electronic wallets – $10.

- Electronic payment system – $0.

- Bank transfers – $3 (often have individual conditions, including possible third-party fees for currency conversion).

Problems and Solutions When Depositing at Exness

Users of trading platforms usually do not experience difficulties with making payments, thanks to the rapid crediting of funds to the deposit and the absence of unnecessary actions. But problems can occur, which often depends on external factors. We’ve identified the most common problems and explained how they can be solved.

- Technical problems. If the deposit error is on their end, contact Exness customer support, where they always respond promptly and constructively to any questions. The support service is available 24/7.

- Incorrect data. If you’ve entered the details incorrectly, check the information for any mistakes made. In a situation where there are no errors but you still can’t send the deposit, please contact customer support.

- Payment unavailability related to a specific region. Log into your account and make sure that this payment method is supported. If not, use a different payment system.

- The waiting time exceeds the specified norms. If you had to wait a long time for the money to be successfully sent to your account, but it never arrived in your balance, it’s possible that you didn’t provide the necessary documents to verify the payment. Without verification, there can also be problems with depositing funds.

- The payment method was declined. This usually happens due to the use of a payment method that was not registered. Transfer money only using the payment methods you specified during registration.

For any unclear situations, please contact customer support, where they will always clarify and assist in resolving the issue.

Deposit Bonus at Exness

Due to its policy, the broker cannot offer clients bonuses for making a deposit. But this does not mean that the user will not have access to additional earning opportunities. There are affiliate programs in which traders can participate and earn profits from interacting with a brokerage company. Sometimes the income from a deposit made can reach almost two thousand US dollars.

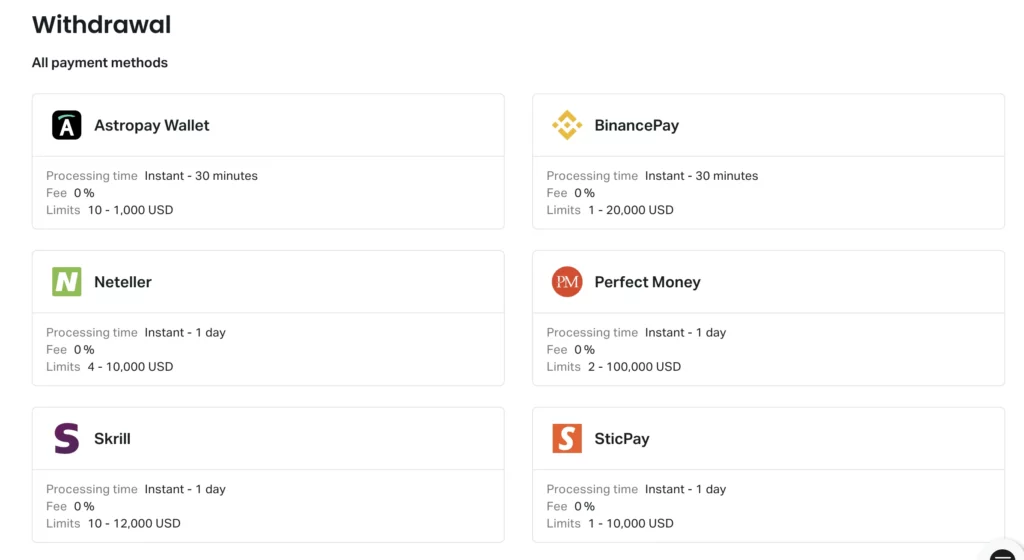

Withdrawing Funds from Exness

In trading, any financial transaction matters, especially one such as withdrawing the funds earned from a successful deal. With Exness, you get uninterrupted access to your trading accounts, which you can withdraw from at any time using the same payment methods as for deposits:

- Debit or credit cards. Depending on the operator, there may be restrictions on withdrawing money. This also applies to the fees that banks may charge for a transaction.

- Electronic wallets. This method of translation ensures instant withdrawal of funds without any commission.

- Bank transfers. To withdraw capital, it is necessary to submit a request to the broker and provide bank details. Exness does not charge a commission per transaction, but banks might do so. The translation time ranges from one to three business days.

The withdrawal of funds is carried out through a clear procedure:

- Log into your account and open the “Personal Account” section.

- In the sidebar menu, find the “Withdraw” option.

- Select the required payment method from the options available.

- In the opened window, enter the access data and amount, then select the currency.

- Provide access to the payment account and complete the withdrawal process.

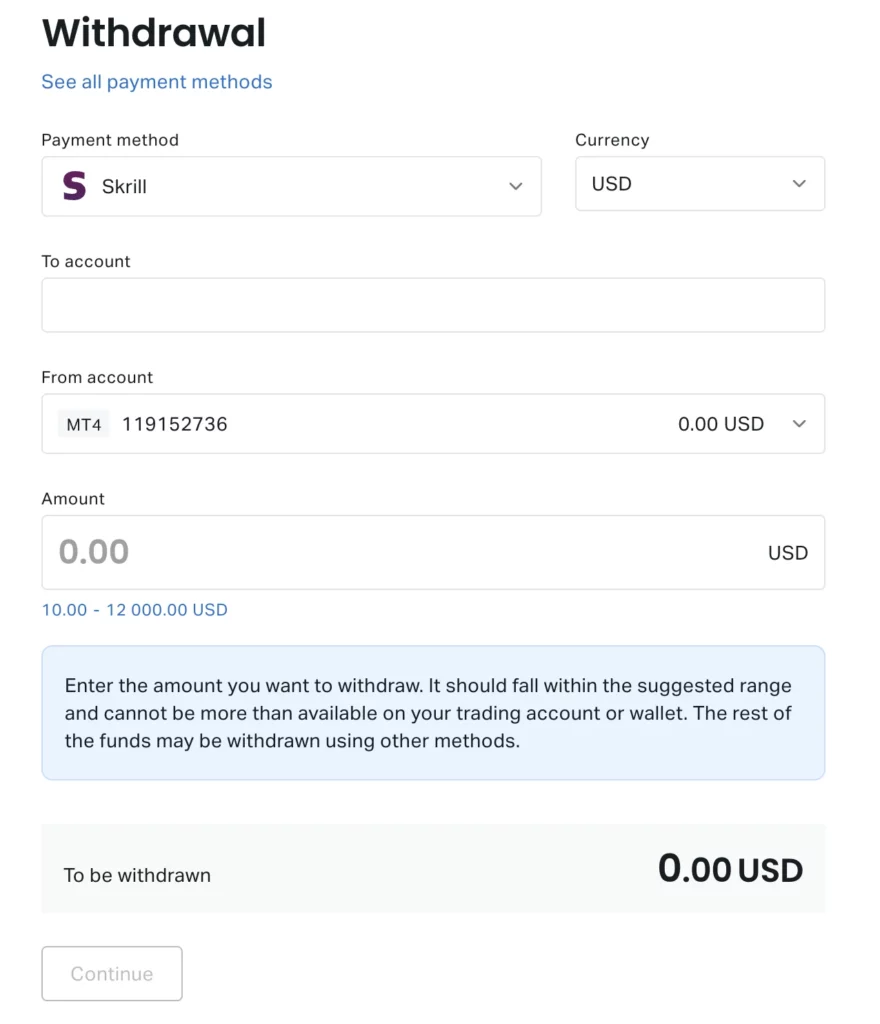

Skrill Withdrawal on Exness

To an electronic wallet, and specifically to Skrill, the withdrawal of money occurs according to the following system:

- In your account, go to the “Withdraw Money” tab.

- Select Skrill from the options provided by clicking on the button with the name of the payment service provider.

- Enter the email address of your wallet that is linked to your account, and input the amount you wish to withdraw.

- Confirm the payment, and the money will be immediately credited to your account without any additional fees.

This payment method is considered reliable and convenient. It is not accompanied by the charging of commissions by Exness; the withdrawal request is processed instantly, and the transaction is executed just as quickly. Please note that only clients who have fully completed the verification process, confirming that they are the account holders, can use Skrill on Exness.

Withdrawal Time

The chosen payment system affects the processing time of the request. Yes, with bank transfers, a transaction can take from one to seven business days. The translation is faster when using a bank card – 24 hours. Payments to electronic wallets are received instantly (there may be a delay of up to 1 day at most).

Limits and Fees for Withdrawals in Exness

There is a limit set on the amount of money that can be withdrawn, and no fees are charged for withdrawals, which aligns with the broker’s concept of conducting honest and transparent operations. If Exness does not charge a commission, then payment providers may impose it at their discretion.

The broker has set optimal minimum withdrawal limits that satisfy both beginners and experienced traders. The size of the minimum one-time limit depends on the payment method and ranges from 1 to 50 US dollars.

Withdrawal Issues and Their Solutions

Although the withdrawal process has been simplified as much as possible, certain problems may arise. Familiarize yourself with the most common problems and ways to solve them.

- The client entered inaccurate or outdated information. Before withdrawing money, it would be wise to read the payment information and provide the correct details.

- The method of withdrawal does not match the deposit payment method. It is preferable for the payment methods for withdrawals and deposits to match.

- For technical issues that have caused problems with withdrawing funds, you should contact Exness support service.

- There is a withdrawal limit, which may be the result of an unsuccessfully passed account verification. Avoiding payment delays is possible after undergoing the verification process, with the provision of all necessary information and documents.

Security Measures for Financial Transactions at Exness

Any operations in the financial sector are associated with certain risks. The broker understands this well, and being an international company with an excellent reputation and vast experience, it implements advanced multi-level measures to protect clients’ accounts and personal information:

- An innovative approach is used for the security of the account. He connects two security vectors. The first is data encryption through the use of a private key. The second is two-factor authentication, which guarantees impeccable protection for the account. With its use, no unauthorized person will be able to gain access to your account.

- The segregation of trading accounts, which ensures the preservation of traders’ funds and the security of financial transactions. Clients’ funds are held in separate accounts, not linked to the brokerage company’s accounts, which reduces the risk of their unauthorized use.

- Thorough verification of data before opening an account. The KYC (Know Your Customer) procedure being carried out is intended to prevent fraud and any illegal activities. It involves verifying personal information and analyzing identity documents.

- Fraud monitoring, which means a system aimed at protecting clients, their accounts, and online payments from malicious actors. Monitoring and detection of fraudulent activity refers to a set of measures that involve real-time payment verification to identify suspicious activity.

- Audit and certification involve the execution of procedures that confirm a brokerage company’s activities comply with international standards.

Tips for Easy Payments in Exness

To avoid problems when depositing or withdrawing money from an account, following practical recommendations will help:

- For all transactions, try to use the same payment method. And moreover, the payment method should be the same for both deposits and withdrawals.

- Payments will be available if you timely confirm your account and go through the verification process according to the rules.

- Keep an eye on your account balance, which you can do in your personal account. This way, you’ll always know how much money you have, whether it’s time to top up your deposit, and if the amount is sufficient for withdrawal.

- Always verify the payment details before conducting any financial transaction.

- In any unclear situations and arising difficulties, please contact the Exness customer support service.

Conclusion

By choosing to collaborate with the brokerage company Exness, you lose nothing but gain round-the-clock support, the opportunity to make purchases, exchange or sell assets at any time, and thereby increase your capital. You are offered convenient transaction conditions, various payment systems that can be used to transfer money to the trading account and also quickly withdraw earned funds. Exness has made the process of depositing and withdrawing funds easy, understandable, fast, and secure. You don’t pay a commission to the broker, which is considered rare in the trading sphere, but you do receive high-quality service, including instant processing of every request.

FAQs: Exness Deposit and Withdrawal

What payment methods does Exness support?

You can use payment methods such as bank transfer, electronic wallet, debit or credit card.