What is the Minimum Deposit on Exness?

Exness is one of the best large, international brokerage firms. Traders of all experience levels and trading skill levels prefer it. This indicates that the conditions offered by Exness are suitable for traders, as they meet their needs, increase the potential for profit, and do not confine clients within strict deposit limit boundaries. When there is a minimum limit, the trader must deposit an amount of money each time that is not less than the established low threshold.

Exness conducts brokerage activities under a license, meaning it is regulated at the legislative level. As a legal brokerage firm, Exness has a specific set of requirements for its clients. A mandatory item on the list is the minimum deposit. Broker services pertain to all types of trading accounts, each distinguished by its unique features. The minimum deposit amount depends on the type of account. For example, a Standard account requires a minimum payment of $1 and above, which mainly depends on the chosen payment system (i.e., the minimum amount it can process). On the other hand, Professional accounts require a minimum deposit starting from $200.

Minimum Deposit for Different Account Types

On the broker’s trading platform, you can open various types of trading accounts, including a demo account, for which depositing funds is not required at all. But we’re talking about real accounts here, of which Exness offers two main types: Standard and Pro.

A standard Exness trading account is suitable for all traders. If you’re starting to trade on financial markets, opt for this type of account, which is characterized by the absence of commissions, unlimited leverage, and essential functions and tools. The minimum deposit depends on the chosen payment method. Its size can be either $1 or $10. The Standard includes a standard account and a cent account. By opening a standard account, you will be able to earn money through trading in currency, cryptocurrency, indices, stocks, metals, and energy carriers. For the liquidity of your assets, the spread starts from three US dollars. The standard lot is chosen for trading micro lots. Forex and metals are used as trading instruments. The benefit of purchasing assets is influenced by the low spread inherent to the trading account – from $0.3.

Professional accounts are created by traders with extensive experience, a large volume of trading operations, and who are willing to take risks for substantial profits. The professional account has three options: Pro, Zero, and Raw Spread. For each type of professional account, the minimum deposit amount is $200. The trading instruments offered include metals, energy carriers, cryptocurrency, indices, stocks, and Forex. The maximum leverage has no limit. The spread for a Pro account starts from one US dollar. For Raw Spread and Zero Spread accounts, a zero spread is offered.

Advantages of a Low Minimum Deposit

The small amount of money that needs to be invested each time for the opportunity to conduct trading operations is advantageous for a trader for several reasons.

- Reduces the risk of financial loss in the event of a failed deal.

- There are no internal fees for deposits when trading on the Exness platform.

- The broker ensures the security of clients’ accounts, their trading accounts, and finances by employing advanced methods of protection and data encryption.

- Client deposits are held separately from corporate funds.

- With a reduced minimum deposit, the client gains the opportunity to use trading tools for free, allowing them to try out various strategies.

- Without a sharp start and significant investments, a beginner trader will be able to practice and learn the skills of stock trading.

- Even with a minimal amount, trading can be made successful if the functionality and conditions offered by the brokerage company are used correctly.

How to Deposit a Trading Account on Exness?

Clients of the broker can replenish their deposit in various ways. Exness does not charge a commission for processing payments. Payment operators may charge a fee for conducting transactions, for which the brokerage company is not responsible. Clients have the ability to transfer funds to their account 24/7. The time it takes for money to be credited to a deposit usually ranges from a few minutes to 24 hours, depending on the specifics of the request processing. Exness trading platforms accept funds in major and minor currencies. And although there is a huge selection of currencies, it’s necessary to consider the region of residence that the trader specified during the account registration, as well as the type of trading account. Please note that a fee may be charged for currency conversion. This occurs in the event that the base currency, which is the primary currency for the trading account, differs from the currency used for the deposit.

Depositing through Bank Transfer

The broker accepts bank transfers, which are processed on average within 30 minutes. After registering on the trading terminal website and verifying their account, the trader funds their account by taking the following steps:

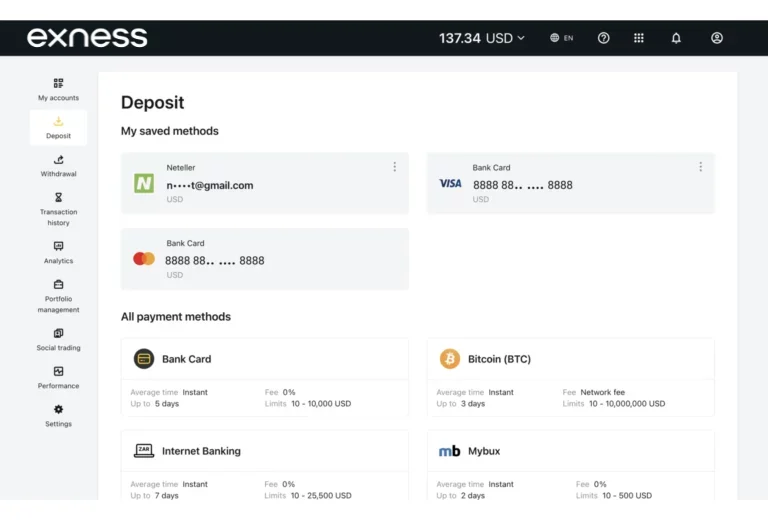

- Login to Exness, go to the toolbar located on the left side of the screen, and select the “Deposit” option.

- Press the button to open the deposit form.

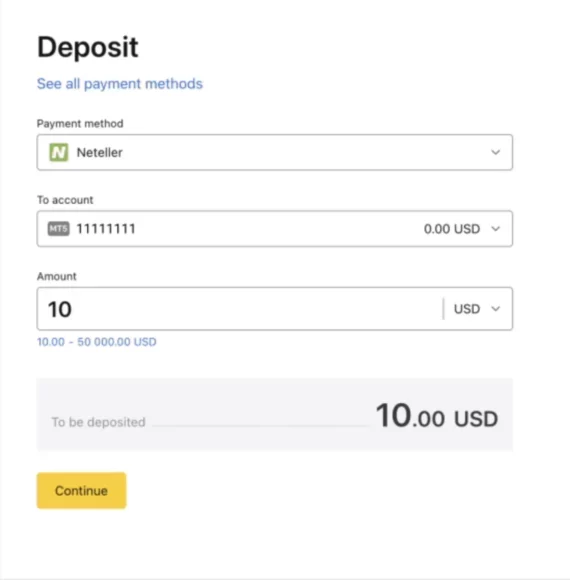

- Choose a payment method available in Exness, such as bank transfer, from the available payment options.

- Enter the amount, specify the currency and account number.

- Click the “Continue” button, after which the system will redirect to the website of the selected payment processor.

- Click “Confirm” to complete the translation process.

Upon completion of the transaction, the funds will be credited to the trading account, and the trader will be notified by receiving a confirmation email.

Depositing with a Credit/Debit Card

Traders can also deposit money using a bank card. The enrollment speed is instant. To top up your account using this method, you need to:

- Log in to your account on the Exness trading platform website.

- Select the “Deposit” icon on the toolbar.

- Proceed to select payment operator options, marking the method as credit or debit card.

- Enter the replenishment amount and the bank card details.

- Press the “Top Up” button.

- The trader will be redirected to the payment system’s website, where their next step will be to select the bank that issued the specified card.

- Press the button to confirm the transfer from the card to the deposit.

Upon completion of the payment processing, the funds will be credited to the personal trading account.

Depositing through Electronic Payment Systems

Traders have the option to fund their trading accounts using electronic wallets such as Skrill, Neteller, among others. For conducting financial transactions, a digital tool is considered the most reliable and convenient method. To use them, it is necessary to follow the instructions:

- Log into your account with your username and password.

- Select the “Deposit” option from the menu.

- In the “account top-up” section, among the listed methods, click the button with the name of the payment system.

- On the page that opens, specify the payment details: currency, amount, and electronic wallet information.

- Complete the money transfer on the payment system’s website.

- A trader can find information about the status of the current transaction and the history of other payments on their personal account page.

Other Important Conditions for Traders on Exness

Clients of the brokerage firm usually do not experience difficulties with money transfers. To prevent issues with depositing funds into a trading account in the future, it is necessary to follow some simple recommendations:

- Provide current details.

- Carefully enter all the data, checking for any errors.

- Before making a payment, complete the verification by providing access to personal data, which will reduce the application processing time.

- Use a registered payment processor that is supported by both the region of residence and the Exness broker trading platform.

An important condition for choosing a payment system also includes criteria such as the speed of deposit processing, the size of commissions, and spreads.

Exness Deposit Processing Time

It takes some time for the payment to be processed and approved. On average, the processing time for a deposit is 30 minutes. However, depending on the chosen payment system, the time it takes to top up the account may be extended. This primarily concerns bank transfers, which can be delayed for up to five business days. Such delays are not observed with electronic wallets and bank cards.

Spreads and Commissions

As already noted, Exness does not charge a commission fee for depositing into an account, regardless of its type. If a fee is charged for the transaction, it is done by the payment operator themselves. The type of account actually affects the size of the spread. If the trading account is standard, the spread starts from 0.3 points. When working with a professional account, traders can expect a spread from 0 or 0.1 point.

FAQs: Exness Minimum Deposit

What is the minimum deposit required to open an account on Exness?

The minimum allowable amount that a trader must deposit into their trading account is 10 US dollars.